Is it wrong to teach children that hard work pays off?

We are still in a very long period of low-interest rate and there’s cheap money everywhere. Banks basically give money away. With a lot of fresh money in the system, that leads eventually to inflation. That means that savings from years of hard work won’t buy you as much as they once could.

Why don’t people talk about high inflation? It’s because inflation is taking place in the financial markets: stocks, real estate, etc. These assets are not included in statistics regarding inflation. In my opinion they should.

Buying a home is one of the most important decision that you will do in your life. This purchas will impact your private economy years to come. Now, there’s a generation growing up during this low-interest period and the only way for them to buy real estate is to take on a huge amount of debt. That’s not a problem! – some say. Because, there’s value in the real estate. That’s true, but compare the price of real estate to the income of the buyer, then compare this ratio over the last generations and you will see something… There is huge unfairness here between younger and older generations!

There is a lesson learned here: earned money from employment won’t buy you much in the real world anymore!

This young generation are facing this reality the hard way. Too many are starting their lives with a huge student loan. On the job market, they are struggling in a world of fierce competition: it’s either you or the AI that will get the job, guess who wins? They are left alone with a college degree and gig jobs. This generation is facing nothing more than brutality and hopelessness. At the same time, the very same generation is accussed of being lazy and easily offended.

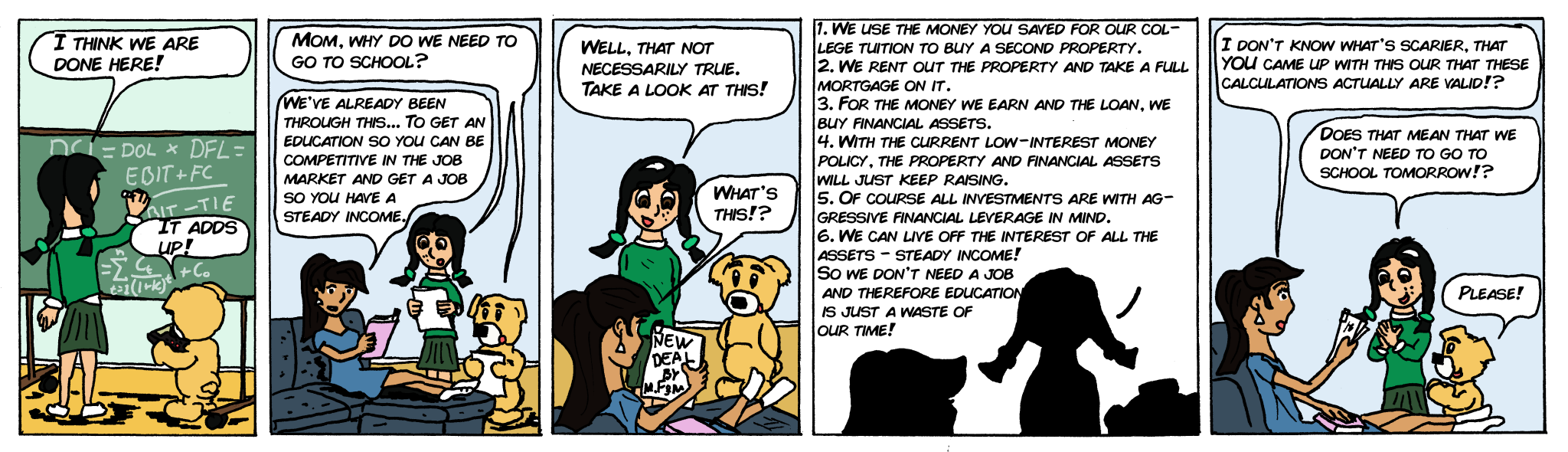

Maybe it’s time to teach children that hard work won’t get you anywhere? But what will then? Easy answer: CAPITAL! Teach your kids about capital, not hard work, if you want them to succeed. And trust me, hard work DOES NOT equal capital. First lesson to be thought is probably about aggressive financial leverage. And when the kids come of age, take a student loan, but don’t use it on tuition, use it in the financial market. And if things go wrong in the financial market? Well, there’s always someone in this circle of people that will recognize your name and bail you out. Do as the bank always does: go crazy, people love it.

Just think about it, in a world where just owning financial assets pay of more than hard work. Which message does that send?

“A man in debt is so far a slave” – still rings in my head…

Anna Fields.